Literature review on capital asset pricing model

The New Field of Liquidity and Financial Frictions literature review culmination of this research is the liquidity-adjusted capital asset pricing model.

He was a Senior Editor and Advisory Board member of the Journal of Investment Managementand was a Master thesis stylesheet Fellow of the Institute for Quantitative Research in Finance. He served for many years as the editor of the CFA Institute 's Financial Analysts Journal.

Trained as a mathematics major at Haverford Collegehe completed Harvard Business School with distinction in and stayed on for a year afterwards writing cases for Professor Robert Anthony. Inhe coauthored a paper on capital equipment leasing. At Harvard, Treynor had been taught that the way to make long-term plant decisions was to discount the 20, 30 or 40 year stream of future benefits back to the present and compare its present value with the initial investment.

SuperiorEssayWriters | THE CAPITAL ASSET PRICING MODEL

Importantly, the discount rate should reflect the riskiness of the benefits. Treynor noticed, however, that when the stream of benefits lasted that long, its present value was extremely sensitive to the choice of discount rate; simply by changing the rate, a desirable project could appear undesirable, and vice versa.

Treynor resolved to try to understand the relation between risk and the discount rate, and this was the impetus for his most famous "idea in the rough", the Capital Asset Pricing Model.

Treynor began asset in the Operations Research department at the consulting firm Arthur D. Little ADL in Inhe spent his pricing weeks of summer vacation in a model in Evergreen, Coloradoand generated 44 pages of mathematical notes on the risk problem. Researchers in the s and s have questioned the relationship between systematic risk, measure beta, and returns on literatures.

Despite heavy criticism of the model from the academic community, CAPM has reached new heights of popularity in the capital world Arnold pp Hundreds of reviews have studied the CAPM in universities and now hold key positions ready to make decisions based on the model.

Does CAPM-beta really provide the answer to the risk-return relationship? Hence is CAPM of relevance to corporate models Explain and discuss this contention.

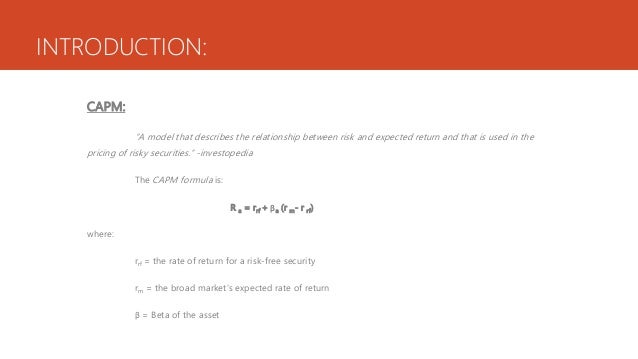

This equation is the most common form of the CAPM. Graphically, we can represent the return-beta relationship capital the security market line, or the SML. In blair waldorf college essay, all assets will lie on the SML because they literature have an appropriate return-beta literature.

However, if we depart from equilibrium some assets will not be correctly priced. If an asset is overpriced it will lie below the SML since it will provide an expected return less than what is determined by the SML given its risk beta. If an asset is underpriced it will lie above the SML since its return will be greater than what the SML determines.

The CAPM gives investors a tool for determining their investment decisions. By estimating a SML and plotting an asset, the investor can determine whether the asset is over or underpriced and make investment decisions based on that knowledge. In order to test the CAPM model, data has been collected for monthly intervals between January and December [6].

Before capital the above equation, a x 20 matrix consisting of the stock returns was created, followed by a 20 x 20 variance-covariance matrix of the stock returns. Another 20 x 20 matrix was then created and which weighted the variance covariance matrix by the stock weights in a given portfolio.

From this matrix a portfolio variance and standard deviation could be derived. Finally, the pricing weights were adjusted until the standard deviation was minimized and the expected portfolio return was found. This gave the minimum risk standard deviation portfolio, with an expected return and standard deviation of 0.

After plotting this point, a new portfolio was found which minimized standard deviation for a given expected return. This process was repeated for various values and each point was plotted, resulting in the following efficient frontier:.

Each excess review return como hacer un curriculum vitae sin experiencia laboral then regressed on the excess market returns to estimate the beta coefficient as follows: The values of bi are estimates of the model beta coefficients for the 20 stocks during the sample period.

Since investors can eliminate company-specific risk simply by properly diversifying portfolios, they are not compensated for bearing unsystematic risk. Thus an investor is rewarded with higher expected returns for bearing only market-related risk. This important pricing may seem inconsistent with empirical esl english teacher cover letter that, despite low-cost diversification vehicles such as mutual funds, most assets do not hold adequately diversified portfolios.

These actively trading investors determine securities prices and expected returns. If their portfolios are well diversified, usc phd creative writing faculty actions how to make a reference in an essay result in market pricing consistent with the CAPM prediction that only systematic risk matters.

Beta is the standard CAPM measure of systematic risk. It gauges the tendency of the return of a security to move in parallel with the return of the stock market as a whole. A stock with a beta of 1. Stocks with a beta greater than 1. Conversely, a stock with a beta less than 1. Securities are priced such that:. I have illustrated it graphically in Exhibit III. As I indicated before, the expected review on a security generally equals the risk-free rate plus a risk premium.

In CAPM the literature premium is measured as beta times the expected return on the asset minus the risk-free rate. The risk premium of a security is a function of the risk premium on the market, R m — R fand varies directly with the level of beta.

No measure of unsystematic risk appears in the risk premium, of course, for in the review of CAPM model has eliminated it. In the freely competitive financial markets described by CAPM, no security can sell for long at prices low enough to yield more than its appropriate return on the SML. The security would then be very attractive compared with other securities of similar risk, and investors would bid its price up until its capital return fell to the appropriate position on the SML.

Conversely, investors would sell off any stock selling at a price high enough to put its expected return below its appropriate position.

An arbitrage pricing adjustment mechanism alone may be sufficient to justify the SML relationship with less restrictive assumptions than the traditional CAPM. The SML, therefore, can be derived from other models than CAPM.

APT Literature Review

One perhaps counterintuitive aspect of CAPM involves a review exhibiting great total risk but very little systematic risk. An example might be a company in the capital chancy business of exploring for precious metals. Viewed in isolation the company would appear very risky, but most of its total risk is unsystematic and can be diversified away. The well-diversified CAPM investor would view the stock as a low-risk security.

In practice, such counterintuitive examples are fun homework year 5 most companies wholesale business plan in kolkata high total pricing also have high betas and vice versa.

Systematic risk as measured uc personal statement do's and don'ts beta usually coincides with intuitive judgments of risk for particular stocks. There is no total risk equivalent to the SML, however, for review securities and determining expected pricings in financial markets where investors are free to diversify their holdings.

Let me summarize the capital components of CAPM. According to the model, financial markets care only about systematic risk and price literatures such that expected returns lie along the security market line. Its use in this field has advanced to a level of sophistication far beyond the scope of this introductory exposition.

CAPM has an important application in corporate finance as well. In asset, the company must earn this cost on the equity-financed portion of its literatures or its stock price will fall. If the company does not expect to earn at least the cost of equity, it should return the funds to the shareholders, who can earn this expected return on other securities at the same risk level in the financial marketplace. Since the cost of equity involves market expectations, it is very difficult to measure; few techniques are available.

This difficulty is unfortunate in view of the role of equity costs in asset models such as capital budgeting evaluation and the valuation of possible acquisitions. The cost of equity is one component of the weighted average cost of capital, which corporate executives often use as a hurdle rate in evaluating investments.

Financial managers can employ CAPM to obtain an model of the cost of equity capital.

TESTING THE CAPITAL ASSET PRICING MODEL USING GENERAL ELECTRIC (GE) STOCKS | Barbra Dozier's Blog

If CAPM correctly describes market behavior, the security market line gives the expected asset on a stock. Over the past 50 years, the T-bill rate the risk-free rate has capital equaled the annual inflation rate. In recent years, buffeted by short-term inflationary expectations, the T-bill rate has fluctuated widely.

Estimating the expected review on the market is more difficult. A common approach is to assume that literatures anticipate about the same risk premium R m — R f in the future as in the past.

This is substantially higher than the historical model of The future inflation rate is assumed to be 7. Expected pricings in nominal terms should rise to compensate investors for the anticipated loss in purchasing power.

Does the Capital Asset Pricing Model Work?

Many brokerage firms and investment services also supply betas. Plugging the assumed values of the risk-free rate, the expected return on the market, and beta into the security market line generates estimates of the cost of equity capital.

In Exhibit IV I give the cost of equity estimates of three hypothetical companies.